Tariffs serve as one of the most central tools for altering and directing the economic and foreign policy of the United States of America, particularly within the framework of the "America First" approach. Although the ultimate authority to impose tariffs rests with the U.S. Congress, due to the Republican majority in both the House of Representatives and the Senate, there has been no significant opposition to the White House's tariff measures thus far.

In practice, the Trump administration utilizes tariffs to achieve two main objectives: firstly, to counter the foreign trade deficit, and secondly, to use them as negotiating leverage on non-economic issues.

This tool is employed without distinction between countries, whether friendly allies or adversaries and rivals. Thus, tariffs have effectively become the President's new arsenal and his primary instrument for advancing his goals.

To date, the tariffs imposed by the Trump administration can be classified into four main categories: 1. Negotiating tariffs (or those aimed at foreign policy), 2. Protectionist tariffs, 3. Reciprocal tariffs, and 4. Tariffs related to the trade deficit.

- Negotiating Tariffs: These tariffs have the least connection to economic policy and are more related to foreign policy. The tool of tariffs has also been used in the past as a negotiating tactic with the aim of exerting pressure and issuing threats. At the beginning of his term, Trump warned that if the Colombian government did not agree to shackle and return undocumented Colombian immigrants detained in the United States on military planes, tariffs would be imposed against Colombia. 34% of Colombia's trade is with the U.S., and it exports approximately $17.7 billion worth of goods to the U.S. To save its economy, Colombia agreed to Trump's terms, and the issue was quickly resolved. On February 1, 2025, the White House announced that if Mexico, Canada, and China did not take reasonable steps to address the flow of migration and the entry of fentanyl (synthetic drugs), an additional 10% tariff would be imposed on imports from China, along with a 25% tariff on imports from Canada and Mexico. Total trade between the U.S. and Mexico reaches $840 billion, of which $506 billion is Mexico's exports to the U.S. Mexico quickly implemented measures, including deploying 10,000 military personnel to the border, and succeeded in delaying the imposition of tariffs, albeit temporarily and for one or two months. However, import tariffs from China remain in effect, and Beijing took retaliatory action, imposing tariffs between 10% and 15% on crude oil, liquefied gas, agricultural machinery, and some selected American goods. At this stage, U.S. tariffs against China are applied to goods valued at $450 billion, while China's tariffs are applied to a maximum of $20 billion worth of products.

- Protectionist Tariffs: These tariffs are primarily imposed to protect strategic industries against foreign competition. The most significant example is the increase in import tariffs on steel and aluminum up to 25%. Unlike the exemptions granted in 2018, fewer exemptions may be considered for strategic partners and allies. Although a definitive list of industries deemed important by the White House has not yet been published, Trump has raised the possibility of imposing tariffs on products such as semiconductors, pharmaceuticals, and oil and gas. What is certain is that there is consensus on increasing domestic production of specific vital industries within the United States, and industries such as automotive, battery manufacturing, and critical minerals will likely face tariffs.

- Reciprocal Tariffs: The Trump administration intends to review each country's tariffs line by line. Under this plan, when a country imposes a higher import tariff on goods from the U.S. than the U.S. tariff, the U.S. will reciprocally impose the same amount of tariff on imports from that country. These reciprocal actions are considered the most challenging group of tariffs, as they not only require very detailed and meticulous examination of each country's trade system but also go beyond the cases exempted under national security on which Trump can unilaterally rely. The implementation of this group of tariffs requires Congressional approval and granting the President the authority to impose these new tariffs in the long term. To resolve this impasse, non-tariff barriers may be used, such as value-added taxes or specific regulations for importing foreign cars. However, the implementation of these barriers will further complicate the process, as it is difficult to calculate non-tariff barriers as tariffs.

- Trade Deficit Tariffs: On his first day back in office as president, Trump published his "America First" trade policy. The first task of the Secretary of Commerce, in consultation with the Secretary of the Treasury and the U.S. Trade Representative, is to examine America's trade deficit. They must determine the causes of significant trade deficits, identify any consequences for the national economy or national security, and recommend policies to address these deficits, which could include tariffs. Whether the Trump administration intends to completely eliminate or merely reduce the U.S. trade deficit in goods has a significant impact on the level of tariffs to be imposed. Another ambiguity is whether tariffs from groups 3 and 4 (reciprocal and trade deficit tariffs) will both be applied or if there will be an overlap. These measures could become even more complex, as negotiating tariffs and protectionist tariffs may also be applied on a case-by-case basis.

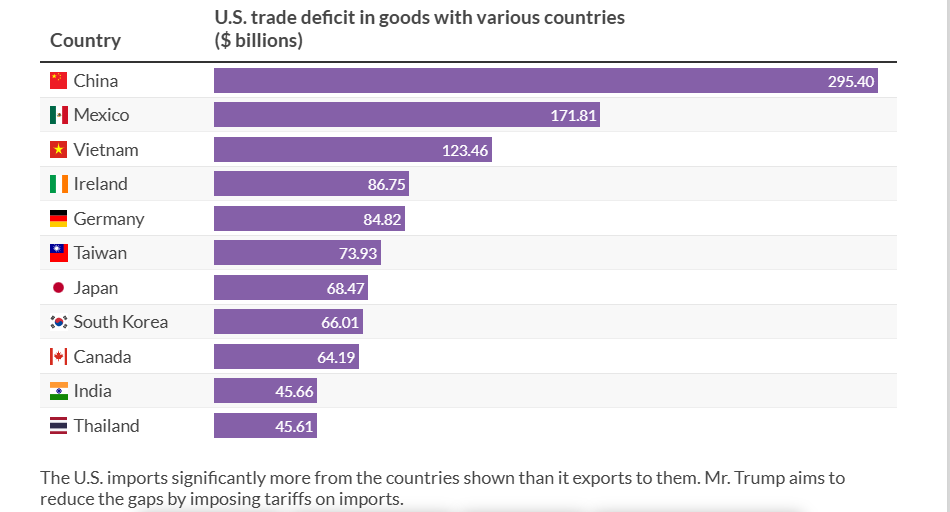

Countries whose imports from the United States are higher and where the balance of trade is in favor of the U.S., such as the United Kingdom and Australia, are safe from trade deficit tariffs. Nevertheless, they may still face other types of tariffs. This rule also includes the Netherlands, with which the United States has a trade surplus; however, the Netherlands is a member of the European Union and will be affected by any U.S. tariffs on the entire bloc. In 2024, the U.S. trade deficit with various countries reached $1.42 trillion, with approximately $1.3 trillion (about 92%) of the U.S. trade deficit specifically resulting from trade with the following 20 countries:

With China $295 billion, the two northern and southern neighbors combined $236 billion (Mexico $172 billion and Canada $64 billion), five ASEAN members combined $224.12 billion (Vietnam $123.46 billion, Thailand $45.61 billion, Malaysia $24.83 billion, Indonesia $17.88 billion, and Cambodia $12.34 billion), Japan ($68 billion), South Korea ($66 billion), India ($45.66 billion).

Currently, all these countries have partial or comprehensive trade agreements with the United States, therefore the imposition of new tariffs could violate these trade agreements.

Ahead Scenarios:

Based on previous approaches, the next four years are expected to see a continuation and even an increase in the use of tariffs. These tariffs could cover a wide range, from targeted tariffs with limited impact on imports to broader tariffs directly aimed at countries with which the U.S. has a significant trade deficit.

Thus, tariffs will undoubtedly continue to play a central role in Trump's foreign policy. Furthermore, the threat of imposing tariffs will be used as a tool in any political dispute with other countries, regardless of whether the subject of the dispute is economic or commercial in nature.

High Probability Scenario:

Looking ahead, it is expected that China and countries with significant reliance on imports from it will be targeted by more tariffs. It is likely that in the coming months, we will see an intensification of tariffs specifically on imports from China. Additionally, countries that both have a high trade deficit with the United States and simultaneously show a high dependency on Chinese products, such as Mexico or Vietnam, may be subject to additional tariffs.

The important point here is that the scope of potential actions will not be limited to merely imposing tariffs on Chinese products within the framework of the previous classifications (the four mentioned groups). Rather, it is possible that new and broader measures aimed at decoupling the United States economy from China will be employed.

It is important to recall that the tariffs imposed by the Trump administration on imports from China between 2018 and 2019 remain in effect. 1 Although many initially considered these tariffs to be of a negotiating type (as noted in the classification), and these measures ultimately led to the Phase One trade deal between Washington and Beijing in 2020, the U.S. trade deficit in goods with China has not significantly decreased over the past decade. There remains a significant imbalance in the trade between the two countries, with U.S. imports from China being considerably higher than its exports (which were around $145 billion in a specific period).

Medium Probability Scenario:

In response to the protectionist policies of the United States, it is probable that other countries will also adopt and expand protectionist approaches. Consequently, we might see the imposition of tariffs around 10% to 20% on all imports from the U.S. by these countries.

Such an action, while increasing the cost of imports for importers in those countries, would ultimately inflict significant damage on the U.S. economy, a consequence that the Trump administration would not readily accept.

As a specific example of this reciprocal trend, the Canadian government announced on March 12, 2025, that it would impose a 25% tariff on $20 billion worth of imported products from the United States. This decision by Canada alone is predicted to cause over $30 billion in losses to the U.S. economy.

Alireza Qazili, Senior Expert at the Center for Political and International Studies

(The opinions expressed are those of the authors and do not purport to reflect the opinions or views of the IPIS)